Decoding Amazon’s Market Position and Value Story

To really understand Amazon’s stock management, you need to look beyond basic sales numbers and examine the key factors that drive the company’s true value in the market. Let’s explore the main elements that shape Amazon’s position and prospects.

The Evolution of Amazon’s Business Model

Amazon’s growth from an online bookstore into a global technology company has completely changed how investors view the stock. While it started by offering convenient book shopping online, Amazon now operates across multiple sectors like e-commerce, cloud computing through Amazon Web Services (AWS), digital advertising, and physical retail. This expansion has created several strong revenue streams that support the company’s market position. AWS in particular has become a major profit driver as more businesses move to cloud services.

Key Drivers of Amazon’s Stock Performance

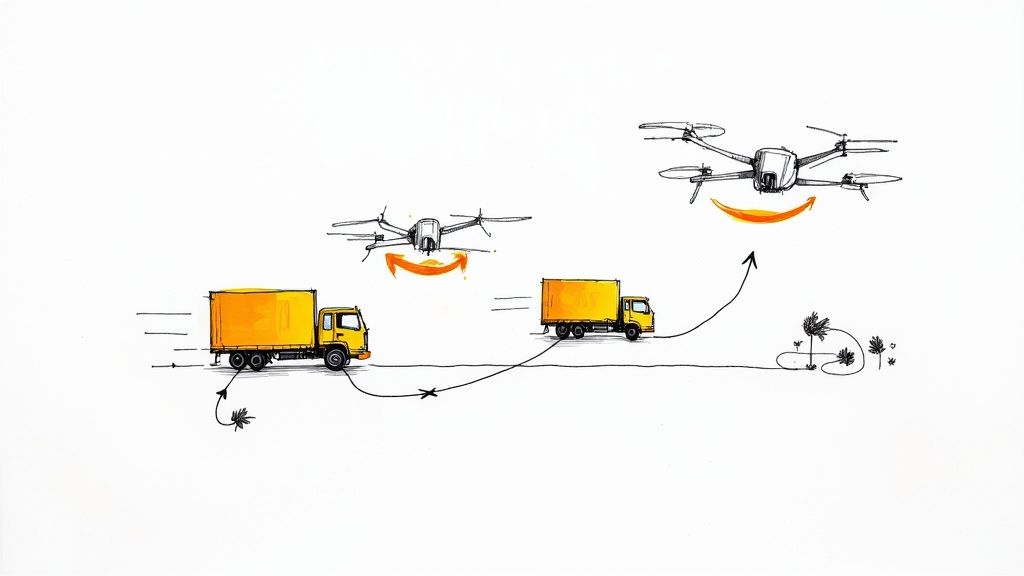

Several important factors affect how Amazon’s stock performs over time. The Amazon Prime subscription service brings in steady revenue while building customer loyalty through its many benefits. This predictable income makes the company more attractive to investors who value stable cash flow. Amazon also keeps developing new technologies in areas like AI and drone delivery, showing it continues to push boundaries rather than becoming complacent. These ongoing innovations signal the company’s commitment to finding new ways to grow.

Amazon’s Competitive Landscape

Smart stock management requires understanding how Amazon stacks up against competitors. The company faces pressure from traditional retailers working to improve their online presence, while also competing with other tech giants in cloud computing and digital advertising. This intense competition keeps Amazon focused on innovation and refining its approach. Analyzing these competitive dynamics provides crucial insight into Amazon’s long-term potential.

Evaluating Amazon’s Financial Performance

A thorough analysis of Amazon’s finances needs to dig deeper than basic metrics like quarterly earnings. For example, while the total number of users and sellers is impressive, looking at their activity levels and revenue generation reveals more about the health of Amazon’s ecosystem. Key operational factors like shipping costs, warehouse efficiency, and return rates significantly impact profitability. Understanding how all these elements work together helps investors make better-informed decisions about Amazon’s market position.

Understanding Stock Split Dynamics and Investment Impact

When Amazon split its stock in June 2022, it marked the company’s first split in over 20 years. This 20-for-1 split made shares more accessible to everyday investors by reducing the per-share price. But what does a stock split mean for investors managing Amazon shares? Let’s explore the key impacts and considerations.

How Stock Splits Affect Share Price and Valuation

Think of a stock split like cutting a pizza – you end up with more slices, but the total amount of pizza stays the same. When a company splits its stock, the number of shares increases while the price per share drops proportionally. As a result, the company’s total market value remains unchanged right after the split. For investors holding Amazon shares through a split, the dollar value of their investment stays the same initially. However, the lower share price often leads to increased buying activity, which can push the stock price higher over time. This is an important factor to consider when managing Amazon stock positions.

Investor Behavior and Market Response to Splits

Stock splits tend to have interesting effects on how investors view and trade shares. The more affordable price point typically draws in new investors, especially individuals who previously found the stock too expensive to buy. This influx of new buyers can create upward momentum in the share price. For example, after Amazon split in 1999, the stock saw major gains in subsequent months. Many investors also interpret splits as a sign that management expects continued growth, which can boost overall market sentiment around the stock.

Long-Term Implications and Portfolio Management Strategies

While splits primarily affect share price and accessibility in the short term, savvy investors need to think about the bigger picture. Timing matters – buying before a split announcement could let you benefit from the typical price bump that follows. However, past performance doesn’t guarantee future results, so it’s essential to study how stocks have behaved after previous splits. When adjusting your portfolio around splits, focus on your risk tolerance and long-term investment goals rather than short-term trading opportunities. Watch out for common mistakes like chasing quick gains while ignoring business fundamentals. By understanding both how splits work mechanically and their broader market impact, you can make smarter decisions about your Amazon holdings. Combine this knowledge with a thorough analysis of Amazon’s competitive position and financial health to spot potential long-term opportunities.

Navigating Revenue Patterns and Growth Indicators

A thorough grasp of Amazon’s complex revenue streams is essential for effective stock management. Rather than just focusing on top-line numbers, investors need to understand the various factors that impact the company’s financial performance.

Deconstructing Amazon’s Revenue Streams

While e-commerce remains core to Amazon’s business, the company has evolved into a multi-faceted enterprise. Amazon Web Services (AWS) now delivers significant profits with higher margins than retail operations. The company’s advertising business and subscription services like Amazon Prime have also become major revenue contributors. This diversification means investors must track performance across segments since each area impacts overall profitability differently. For example, a 1% change in high-margin AWS revenue can affect earnings more than a similar change in retail sales.

Identifying True Growth Catalysts

Smart analysis of Amazon’s revenue requires looking beyond quarterly comparisons to spot real growth drivers. While seasonal spikes during Prime Day and holiday shopping provide temporary boosts, sustainable growth comes from expanding the seller base, Prime membership growth, and increased AWS adoption. These metrics indicate Amazon’s expanding market presence and customer engagement – key factors for long-term revenue stability.

Unmasking Warning Signs in Financial Reports

Monitoring financial reports helps spot early warning signs. A slowdown in AWS growth rates, flat Prime membership numbers, or declining profit margins in any segment could signal emerging challenges. By examining performance at the business unit level rather than just total revenue, investors can identify potential issues before they significantly impact the stock. This detailed analysis helps guide timely adjustments to investment strategy.

Metrics that Matter for Long-Term Value

Several key metrics help assess Amazon’s long-term potential beyond basic revenue figures. Average revenue per user across segments shows how well the company monetizes its customer base. Warehouse and logistics network expansion demonstrates Amazon’s ability to handle growing demand. Research and development investments, especially in automation and AI, reveal the company’s commitment to innovation. Together, these indicators paint a clearer picture of Amazon’s future growth trajectory and help inform stock management decisions.

Mastering Quarterly Performance Analysis

After exploring Amazon’s various revenue streams and growth metrics, let’s examine how to analyze their quarterly performance effectively. Far from just scanning topline numbers, this analysis requires careful examination of the underlying patterns that indicate Amazon’s financial health and helps inform stock management decisions.

Deciphering the Earnings Report

Each quarterly report from Amazon contains extensive information that can seem overwhelming at first. To analyze these reports effectively, focus on three key financial statements. First, review the income statement to see revenue, costs, and profit. Then examine the balance sheet for a snapshot of assets and liabilities. Finally, study the cash flow statement to understand how money moves through the business.

Beyond the Headlines: Unveiling Key Trends

While many focus on basic metrics like revenue and earnings per share, deeper analysis reveals more meaningful insights. For instance, examining specific growth rates across Amazon Web Services, advertising, and e-commerce shows which parts of the business are performing well or struggling. Looking at operating margins and free cash flow provides better insight into Amazon’s actual profitability than revenue alone. This detailed analysis helps avoid misinterpreting surface-level numbers.

Seasonal Impacts and Cyclical Patterns

Amazon’s business naturally fluctuates throughout the year, with major spikes during Prime Day and holiday shopping periods. Because of these seasonal patterns, comparing consecutive quarters can be misleading. Instead, compare results to the same quarter from previous years for a clearer picture. A drop in sales after the holidays is normal, but a significant year-over-year decline could signal problems worth investigating.

Forecasting Future Performance: Hidden Indicators

Some less obvious signals can hint at Amazon’s future direction. Pay close attention to what executives say during earnings calls and press releases about upcoming plans and challenges. Also monitor broader economic trends – strong cloud computing spending usually benefits AWS, while weak consumer spending might hurt e-commerce. Understanding this larger context helps predict potential impacts on Amazon’s business.

Building a Framework for Quarterly Analysis

To manage Amazon stock effectively, develop a systematic approach to analyzing quarterly results that includes:

- Key Metrics Tracking: Monitor essential measures beyond revenue, like segment growth rates, margins, and cash flow

- Year-over-Year Comparisons: Compare current results to the same quarter last year to account for seasonal patterns

- Management Commentary Analysis: Review leadership’s comments about plans and risks

- Industry and Economic Context: Consider how broader market conditions might affect different business segments

Following this structured approach provides a deeper understanding of Amazon’s quarterly performance and supports smarter stock management choices. Making decisions based on thorough analysis rather than headlines helps investors better navigate market changes and align their strategy with long-term goals.

Building Your Amazon Investment Strategy

Smart investing in Amazon stock requires more than just buying and holding shares. To build an effective strategy, you need to understand how the company performs, what drives market movements, and most importantly – how Amazon fits into your personal investment goals. Let’s explore the key elements of creating a solid Amazon investment plan.

Position Sizing and Entry Timing

Getting started with Amazon stock means first deciding how much to invest. Consider what percentage of your portfolio should go into Amazon shares based on your comfort with risk and investment timeline. For instance, if you prefer safer investments, you might put a smaller portion in Amazon stock. But if you’re focused on long-term growth and can handle more volatility, a larger position could make sense.

Finding good times to buy is also important, even though perfect market timing isn’t realistic. Some investors build their position gradually by buying small amounts over time – this “dollar-cost averaging” approach can help smooth out price swings. Others watch for temporary dips in the stock price as opportunities to add shares at lower levels.

Managing Concentration Risk

Since Amazon’s stock price can move significantly up or down, it’s crucial not to have too much of your money in one place. Even with a strong company like Amazon, putting too many eggs in one basket exposes you to unnecessary risk. By spreading investments across different types of assets, market sectors, and global regions, you create a buffer against Amazon’s price movements. This way, if Amazon underperforms, your other investments can help maintain portfolio stability.

Adapting to Market Conditions

Markets constantly change, so your Amazon investment approach needs flexibility. During economic uncertainty, you might reduce exposure to growth stocks like Amazon in favor of more defensive investments. When economic conditions improve, you could increase your Amazon position to capture growth opportunities. Regular portfolio reviews help ensure your strategy stays aligned with changing market dynamics.

Strategies for Different Investor Profiles

Your optimal approach depends on your unique situation and goals. Long-term retirement investors often prefer steady growth through buy-and-hold strategies, focusing on Amazon’s business fundamentals and reinvesting any dividends. More active traders may watch short-term price patterns and use technical indicators to guide quick trades.

The key is matching your strategy to your needs. This means defining clear investment objectives, understanding how much risk you can handle, and choosing appropriate investment vehicles. Some investors access Amazon through tech-focused ETFs for broader diversification, while others prefer direct stock ownership for more control. Success comes from combining deep knowledge of Amazon with investment choices that fit your personal financial goals.

Remember to monitor Amazon’s performance regularly, stay informed about market developments, and periodically review your strategy. This keeps your investments on track toward meeting your objectives over time.

Future Growth Catalysts and Risk Management

After analyzing Amazon’s current market position and performance, it’s essential to look ahead at potential growth drivers and risk factors that could affect the stock. Understanding these elements helps investors make more informed decisions about their Amazon holdings.

Emerging Technologies and Market Expansion

Amazon continues to invest heavily in new technologies that could reshape its business. Take artificial intelligence and machine learning – these tools are already improving warehouse operations and customer recommendations. The company’s experiments with drone delivery could speed up shipping times while cutting costs. Plus, as more people around the world start shopping online, Amazon’s push into new countries opens up fresh growth opportunities. For example, rising internet adoption in India has made it one of Amazon’s fastest-growing markets.

Competitive Dynamics and Disruption

The competitive landscape poses ongoing challenges for Amazon. Established retailers keep improving their online presence, while specialized e-commerce sites target specific product categories. Take Chewy in pet supplies or Etsy in handmade goods – these focused competitors can sometimes serve niche markets better than Amazon’s everything-store approach. This means Amazon must keep adapting its strategy to maintain its market leadership.

Building a Robust Risk Management Framework

Smart investors protect themselves by spreading investments across different companies and sectors. Think of it like planning a road trip – you wouldn’t want just one route to your destination in case of unexpected detours. Similarly, having a mix of investments helps cushion against market swings. Beyond diversification, staying up-to-date on industry news, regulatory changes, and economic trends helps spot potential issues early.

Monitoring Key Performance Indicators (KPIs)

Keeping tabs on important metrics helps gauge Amazon’s health and growth trajectory. Key numbers to watch include AWS revenue growth, Prime membership trends, and international sales figures. These indicators can reveal emerging strengths or weaknesses. For instance, if AWS growth slows significantly, it might signal increased competition in cloud services. Regular monitoring lets investors adjust their strategy before small issues become big problems.

Practical Strategies for Adaptation

Markets change constantly, so flexibility is crucial for long-term success. This might mean adjusting how much Amazon stock you hold based on company performance and market conditions. Some investors choose to gradually shift portions of their portfolio into promising new areas while maintaining core long-term positions. Much like a skilled captain adjusts course based on weather conditions, successful investors stay focused on their destination while making tactical adjustments along the way.

Managing your Amazon stock effectively can be challenging. Refunzo helps simplify part of that process for Amazon FBA sellers by assisting with recovering potentially lost revenue due to FBA errors.